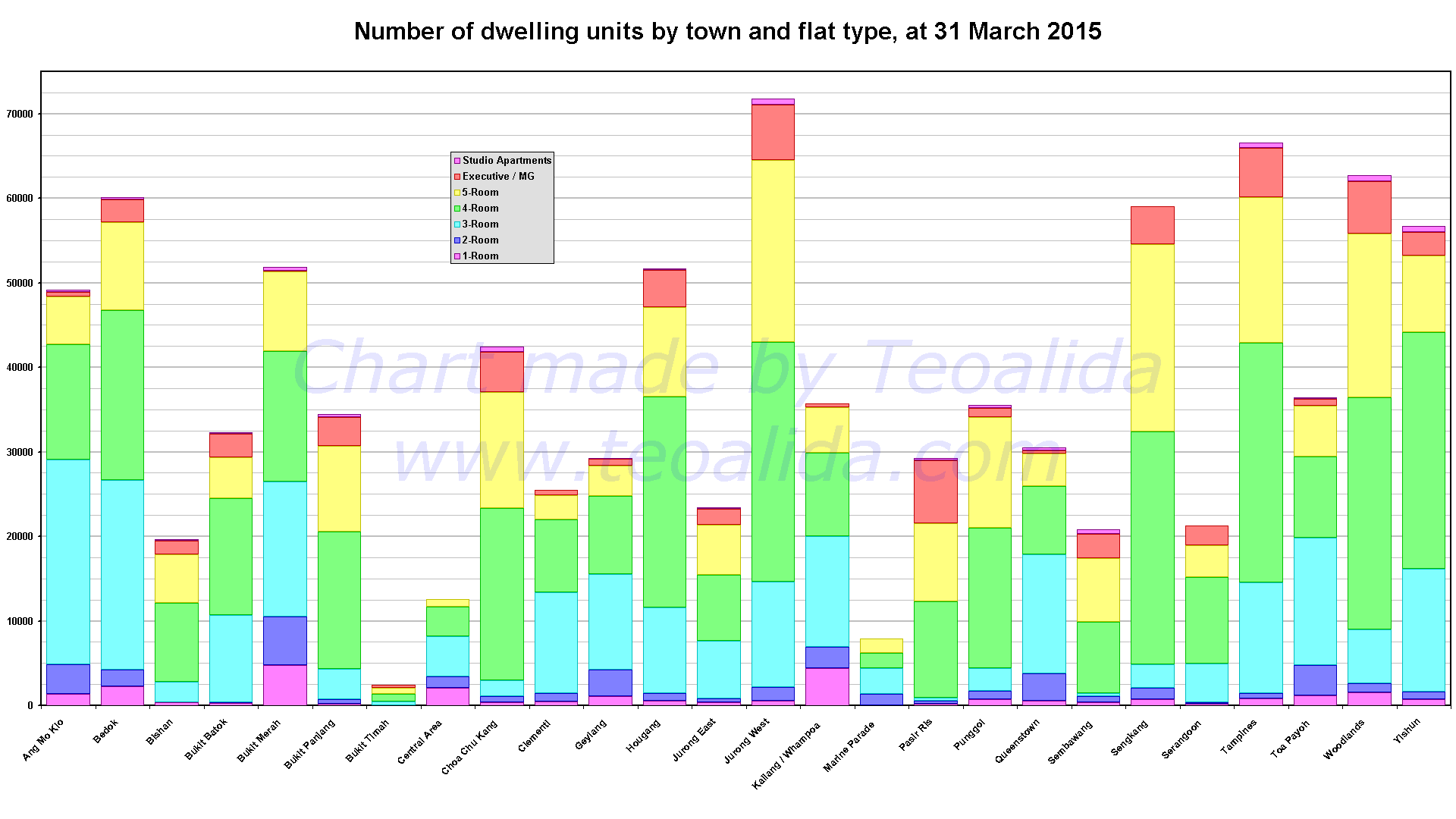

HDB Resale Price Index DOUBLED from 2007 to 2013, dropped 10% to 2015 then stabilized until 2020 when COVID-19 pandemic created another rise.

The below charts generated from Excel analysis shows price evolution for each town. Click towns on right side to highlight lines.

Note: HDB do not provide median price if less than 20 flats were transacted per quarter, thus there are gaps in lines. Especially in case of Executive flats, HDB do not display median prices for Bishan and Queenstown (towns famous for $1 million HDB flats) because they do not have at least 20 transacted flats except in Q2-Q3 2008.

Download Excel price analysis

In 2013 I sourced data from HDB Resale Statistics and compiled an Excel file showing HDB price trends since 2007, and based on it I created the charts seen on this page. Due to requests from 3 people, in 2020 I compiled similar Excel file sourcing data from HDB rental statistics. See below video what do you get after payment. Updated every 3 months.

Price trends in 1990s and 2000s

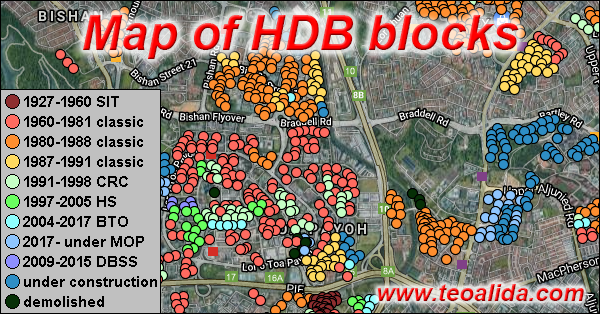

During 1990s, the location was not so important. Like today, Bishan and Bukit Timah had the most expensive resale flats, but a thing less known by the young generation, is that Choa Chu Kang and Pasir Ris were also among expensive estates. Mature towns like Queenstown, Toa Payoh and Ang Mo Kio were cheaper.

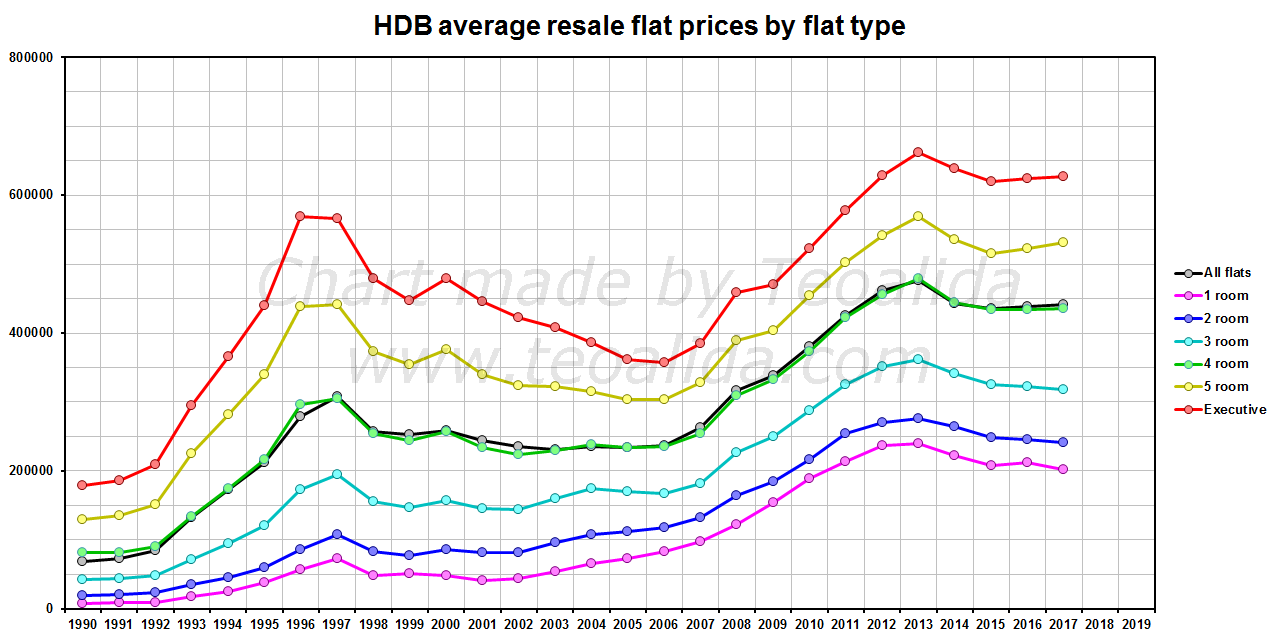

Larger flats types had higher price per square meter or feet than small flats, in 1990-1992 average resale price of Executive flats being double than average resale price of 4-room flats, at an area 40% larger.

HDB stopped deciding the prices of new apartments based on construction costs, instead they decided based on market prices. Prices of resale flats and new flats entered in a vicious circle, rising 50% in just 6 months of 1993 and tripled to 1996. The gap between small and large flat types in terms of price per square feet has decreased.

The 1997 Asian Crisis came when 80.000 flats were under construction, demand for new flats felt sharply. leaving HDB with about 40,000 unsold completed flats in the year 2000, mostly large flat types. 2003 SARS outbreak affected economy too. Queue selling system (Registration for Flat) was suspended in 2002, Build-To-Order was introduced to prevent oversupply, and Walk-In-Selection was used between 2002 and 2007 to clear the stock of unsold flats.

The old estates built in 1960s and 1970s suffered from dilapidated buildings, aging population and businesses moving out, so HDB launched various upgrading programmes and Selective En-bloc Redevelopment Scheme to bring them in the line with new estates. Resale flat prices in old estates (where most 3-room are located) started rising in 2002, while in new estates they continued to fall until 2006, Executive flats having biggest fall. Price per square foot between small and large flat types equalized in 2005.

Walk-In Selection ended in 2007 and was replaced by Sale of Balance Flats that is only twice per year and in some towns more than 10 people battle per each flat. BTO became main mode of flat supply. People who cannot wait 3-4 years construction time for BTO and fail at SBF, need to go in resale market. Resale prices started rising.

Prices grew faster in pre-1980 estates fueled by upgrading programmes and agents lying people that all old blocks will get SERS, making prices in Marine Parade, Queenstown, and Toa Payoh to rival those in with Bishan and Bukit Timah. Pasir Ris had lowest price growth.

Singapore economy recovered in late 2000s but HDB failed to anticipate, it ramped up the BTO supply too late and too slow, they offered 5500 BTO flats in 2007, 7800 in 2008, 9000 in 2009 (global recession), 12000? 16000 in 2010, 22000 25000 in 2011, 25000 27000 in 2012, plus DBSS flats and Executive Condos. (strikethrough numbers are initial numbers announced at beginning of year).

Rising supply of BTO became visible in 2012, a small reduction in resale prices growing rate.

HDB lowered minimum application rate for BTO to be built from 70% to 50% in 2011, but since mid-2000s to 2013 no BTO had application rate under 100% (except elderly Studio BTO flats).

Analysts predicted that the prices in Singapore will start dropping in 2012 (example), as they predicted in 2011, 2010 too. In my forecast, resale flat prices will NOT fall even in 2012, but will continue to grow for as many years as HDB refuse to build ahead of demand, forcing us to wait 4 years via BTO!

HDB introduced multiple measures to cool down the market, but all failed, for example Minimum Occupation Period lengthen to 5 years for resale flats in 2011 (does anyone know when 5-year MOP was introduced for new flats?) just made less flats to enter resale market and the number of people not eligible for buying directly from HDB (for example PR and singles) is growing.

Most of BTOs launched in the 3 years 2009, 2010, 2011 been completed in only 2 years 2013-2014… 25000 flats completed in 2014 alone + 5 years MOP = possible market crash in 2019. I am not saying that prices will not start to fall earlier, but 2019 may have the biggest price fall (if other variables would not exist).

Note: The above text was written by my personal research at end of 2011. Later I found a similar research on h88.com.sg: Colin Tan: HDB resale flat prices will stay up, dating from Feb 2012, that confirm my hypothesis They say that prices will drop no sooner than 2017! Oh dear…

Prices dropping since 2013

One of the cooling measures, 3 year waiting period for permanent residents to buy resale flats, introduced in August 2013, created fear that the housing market may crash. Resale flat prices dropped in 3rd quarter 2013, for the first time in 5 years. Such minor drop in prices may cause panic, many owners rush to sell their flats before prices fall more, leading to a chain reaction in price drop, OR if the panic may be just temporarily and prices will rise back next year. However, there are no signs to recover. Every quarter of 2014 added 1-2% drop in prices. No significant drop but still enough to make analysts ANGRY that HDB cooling measures were too powerful and requested to be lifted.

Note that HDB can also invent anti-cooling measures in case prices drop with more than 10% in one year, and these anti-cooling measures can fail as most of the cooling measures failed. HDB wants to stabilize prices, a too sudden drop can be disastrous for entire Singapore economy.

Stupidity: instead of providing an adequate supply of flats, they kept supply low during 2000s despite of population increase, and while demand was rising too few flats entered in resale market, then during 2010s HDB artificially slowed down demand for resale flats with cooling measures, and when prices started to drop, instead of keeping supply high and lift the cooling measures, they announced to decrease supply of new BTO flats 24300 units in 2014 to 16900 units in 2015. A stupid decision! BTO launches do not affect resale prices directly so we expect to see prices dropping and further decrease of BTO supply in the next years, thus the 2008-2013 price bubble risk to happen again during 2020s!

Personally I hope that HDB will let the price index to drop slowly to 150 (2009 level), THEN lift the cooling measures, but keep the supply of at least 25000 BTO flats per year.

New BTO flat prices won’t fall according resale price index, they were traditionally priced 20% cheaper than nearby resale flat prices, but since 2011 they were “de-linked” and became 30-40% cheaper (even if we exclude grants for first timers) as the HDB anticipated market fall. Even if the prices fall 10% for 3 consecutive years, BTO flat owners will still have profit from selling their flats. This does not apply for DBSS flats which were overpriced at their launch in 2011-2012. Raised income ceiling from $10k to $12k in 2015 may allow HDB to push up BTO prices. Income ceiling was raised again to $14,000 on 10 September 2019 (source).

See also:

HDB new flat prices database (1984-present)

BTO prices database (2001-present)

Resale flat prices database (1990-present)

https://kendata12345.wordpress.com/category/4-hdb-bto-flats-price-and-cost-analysis/ – Another website did a detailed analysis of cost of building a BTO flat compared with selling price. He copied my Excel file of BTO prices without my approval.

Prices growing again since 2020

When COVID-19 pandemic started, I was expecting prices dropping like during 2003 SARS, but contrary happened: internet connection available nowadays allowed people to work from home, and despite that pandemic caused a short-term global recession, it increased inflation and changed people lifestyle towards investing more in (bigger) homes, further accelerating prices growth especially in outer towns.

What you should know

– Upgrading programmes and upcoming MRT lines also drive up the nationwide resale price index.

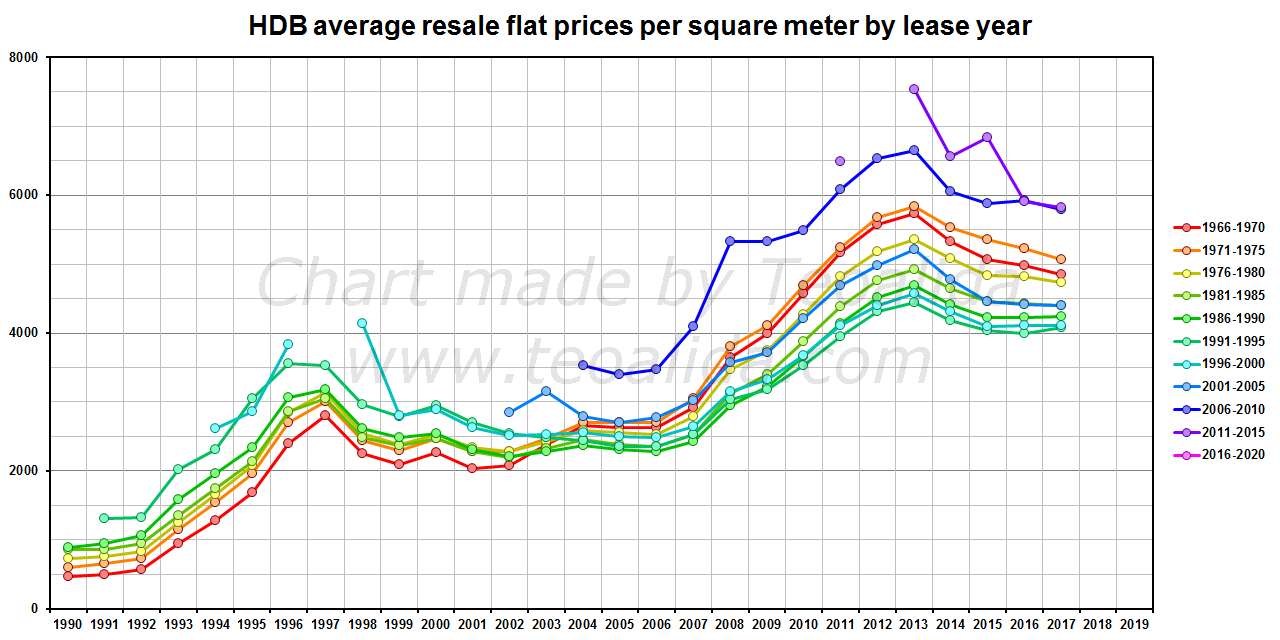

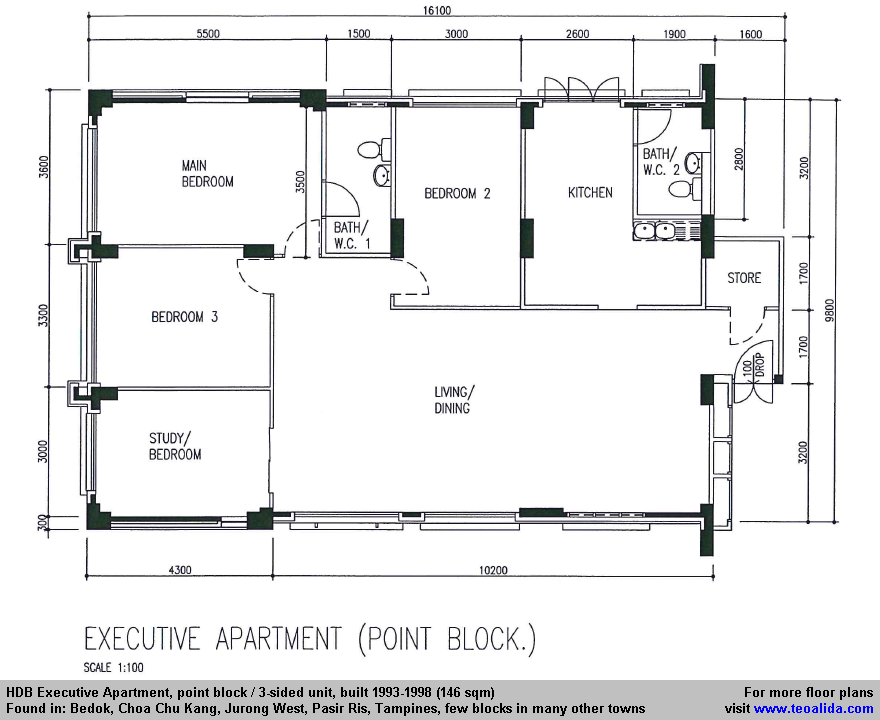

– The small size of today flats may encourage people to go in resale market for flats built before 1998 (NOT SURE if this push up the resale prices, record of psf is now hold by resale flats built in 2000s).

– Prices fall faster in young towns than mature towns, Punggol suffered biggest price fall in late 2013, as results of over-speculation during last years, this after it was the cheapest town in mid-2000s.

– In mature towns prices fall faster in the old 10-storey blocks of Queenstown and Toa Payoh that are getting shadowed by the new 40-storey blocks.

Are HDB flats still affordable?

YES! Every launch, the higher priced BTOs (better locations) gets most applicants.

HDB Website shows application rate. See how 3-room remained unsold and how big is the battle for 5-room despite of higher prices. See the TRUTH about shrinking HDB flat sizes!

Survey

As you can see in the chart, Singapore HDB flat prices DOUBLED in 2008-2013 due to insufficient supply of new flats.

Would you like prices dropping next 5 years to the early 2000s value? Think about owners who worked hard to pay current flats which will lose half of value! Would you like prices growing so you and everyone else can make profit selling? Think about your kids, how hard they will need to work to buy their first home!

Poll started February 2016. See also results of previous poll (379 votes between April 2014 and February 2015).

a

a

a

a

Its mid 2019 , any update on your hypothesis that market will crash?

As you can see, what I wrote 8 years ago is still valid, https://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/resale/resale-statistics#resalepriceindexrpi1383800299748-3 prices are slowly FALLING, the reduction in HDB supply prevented them to fall too much, and the only update I have is that they will continue to fall, maybe fall even faster in the next year.

2022 now, seems that Resale Prices is only rising since 2019. 🙁 Do you see resale prices falling soon?

I just sold my Sengkang private condo and I’m thinking of moving to a maisonette (in a mature estate) for the space and affordability. Do you think this is a bad financial decision or should I just hunt for another private condo?

Going in line with the report here by Teoalida, I have just sold my condo and is staying in a rented place. I am waiting for HDB prices to drop and then purchase one. I am prepared to wait till early 2020. With the current economic situation and if there is still no sign of any improvement, a recession may also be on its way making this prediction even more likely. Maybe a more controlled recession with lesser woes than the usual norm.

Hi Samuelson Tan, if you anticipate that recession is coming, then why not have a place of your own right now and rent out for passive income to help you ride over the recession period?

I do have clients worrying that their job is ‘not secured’ especially when economy is not doing well. It is normal to feel worry. But why do people get worried when they lose their job, is partly because they never do other form of investment to tide them over such situations. That’s why if you have a place of your own to rent out, it will become a Calculated Risk Investment.

You may like to contact me at [email protected] to know more and I promised it is non-obligatory with no strings attached.

Sorry, please use my new email [email protected]

Hi Angline, just sharing some penny of thoughts here as a real estate agent. I have witnessed many couples buying private condo as their matrimonial flat or EC, they are mostly in their 20s-30s. Their reason is that the environment is more conducive with facilities suitable for their young kids or when they are having a house gathering. Security is tighter to keep non-residence out of the compound. All in all, the housing trend has tilted in favor of private housing in Singapore residential scene. Piermont Grand, Woodleigh Residences, The Florence, Riverfront, Treasure at Tampines, The ESTA, Amber Park and many more, their showrooms are packed with people and half of the units are taken within a short timeframe. Why is it so?

Current HDB value is indeed dropping as what the author of this website has shared using chart & figures, and also you can see from HDB resale statistic that 2019 HDB resale prices has steadily gone down since 2017. I am not mentioning BTO because prices for these housing is fully controlled by the government, therefore, will not be accurate in monitoring the true market value of HDB. Now is 2019, almost half of 99yr lease HDB island-wide is coming to or has gone beyond the 60yrs mark. Government is still unable to provide a peace of mind to current HDB-owners as what is to come when their 99yr lease reaches the end. Although government has introduced SERS, VERS, downsizing scheme or lease-buy-back, it is still not providing a clear answer to all the woes. If you were to purchase back HDB, then you need to think further what is your future plan? Is it purely for your own stay? Do you plan to have a big family? As times goes, will the family members move out to a house of their own, resulting in lesser people staying in a maisonette? By then, is the maisonette space still good enough for the remaining members? Will you consider to downgrade to smaller unit? Are you prepared to accept that your maisonette will fetch lower price than what you have paid for?

On the other hand, let’s talk about private. Regarding the remaining lease coming to near end, owners do not have as much woes as HDB owners because they are in control whether all owners are agreeable to sell their land to developer. HDB owners can’t sell land back to government and government has not given assurance that they will pay back market price for the units once the land reaches 99yrs. Let’s say, you may want to go into some investment in the future, condo rooms or unit rental are more sought after for the amenities and rules are less stringent than renting out HDB.

Having shared that private condo are much more valued by buyers than HDB in general, there are also many buyers in the HDB sector too. The needs, budget and purpose are very different for these 2 groups of buyers. For yourself, you need to identify your requirement/needs and prioritize them so that you can come to a conclusion which is suitable for you and family.

If you would like to know more, I’ll be glad to share with you at no obligation attached. Your can email me at [email protected]

Sorry, please use my new email [email protected]

All in all, the housing trend has tilted in favor of private housing in Singapore residential scene. Piermont Grand, Woodleigh Residences, The Florence, Riverfront, Treasure at Tampines, The ESTA, Amber Park and many more, their showrooms are packed with people and half of the units are taken within a short timeframe. Why is it so?

You have lost all credibility by saying the above. Half of the units are taken within a short timeframe you have stats to back it up ?

Hi Joh, you may like to check out The Business Times on private home sales trend and happenings at below URLs. You can find a lot of recent condo projects and their sales through browsing through their sites and determine by yourself if the private housing scene is as what I have stated. I believe their words are much more credible than mine. It’s also a website where I gain a lot of knowledge on real estate scene. And of course The Business Times is 1 of the many platforms you can gather such info. You can also counter check property websites like propertyguru etc… or the developer’s websites, sometimes they do share info on their sales progress.

https://www.businesstimes.com.sg/companies-markets

https://www.businesstimes.com.sg/real-estate

Hi, my parents who are in their 80s have a 2-room HDB that they are renting out for income. It is located in a near town housing estate with one MRT station and another one coming up in 2020.

Ideally, the unit is a cash cow as they moved in with me and they can rent out the unit. But they are very unhappy in my house as my husband often makes them feel unwelcomed. The marital conflicts between me and my husband also add to the stress levels of the old folks. He often uses my parents as scapegoat for the failure of our marriage when this is not true. i would like to live separately from him but i have nowhere to go.

Logically, it looks like for our sanity’s sake, it is best that my parents sell their unit and buy a bigger unit with an extra room so that they can move out and i can even move in with them. But financially, i do not know if it is a wise decision. What if we sell their home and the government decides to start SERS for the estate? They would lose out on that if they sell now.

Their unit is very old built in the 60s with lease starting in 1971. It is a small flat so it would not fetch very much on the market and with the proceeds, they won’t have many options on the resale market.

Would you be able to offer me advice that can guide me in the decision? My parents are supportive of me but i don’t wish to cause them to lose out on retirement income, as their flat is their only asset and they don’t have other savings.

Appreciate if you can drop me an email reply.

Parents are close, very close, but a successful marriage is for life – long after our parents are gone. Do consider that. While we may love our parents, let not that jeopardise our marriage. Or we could end up single and lonely when our parents pass on. That’s not what our parents want us to be in!

Thanks for ur advice but as i said, my parents are the scapegoats. He treats me very badly and he has pushed me before when i was pregnant and thrown and smashed my things. in short, his behaviour is abusive and that’s why i am trying to find a way out and a roof over my head. After this bad experience, i feel that every woman should be financially savvy as younger guys now are more selfish and very different from last time. They do not cherish their wives even though their wives have quit their job to take care of the family. Hence very important that women know about investment and property. So that should anything happen, we are not left in the lurch. And we have some means to care for our kids.

HDB prices should fall until it matches our salary rate of growth. Singapore land area so small, how can the government allow speculation of housing? Invest in stocks ETF to grow your savings. Do you see the folly of flipping tiny private and public housing which affects the generations down the line? Small space, high psf, no more greenery. Falling public housing prices allow more savings to be invested in other places that dont kill our quality of life! Want to be a real estate magnate? Buy from countries outside Singapore.

your are article very Helpfull. Thanks

6 Aug 2022

Why HDB resale did not crash?

Great information for HDB prices. It’s useful for me.

HDB price trends are influenced by various factors, including economic conditions, government policies, and market demand. Over the years, the Housing and Development Board (HDB) in Singapore has implemented measures to ensure housing affordability and stability. These measures, coupled with Singapore’s economic resilience, have generally contributed to a steady increase in HDB prices. Additionally, AI software development services have played a role in shaping the real estate landscape, providing innovative solutions for property valuation, market analysis, and customer engagement. As technology continues to evolve, the integration of AI in the real estate sector may further impact HDB price trends, enhancing efficiency and decision-making processes within the market.